Bank Closures and the Convergence of Control

During the Pandemic of 2020 our movements and choices were highly restricted in the U.S. like never before. Select people were allowed to work after being deemed “Essential,” only certain stores were allowed to stay open, and only certain events were allowed to progress. Violent BLM riots were celebrated while churches in some areas were forced to close. Your free movement was determined by whether you were “vaccinated” or not. Our choices were funneled.

Sadly, the recent bank closures could be another red flag of the increased funneling we are experiencing. It is true that many in the global financial sector are dreaming of a day when they can control every single $100 dollars people wish to spend and where. John Titus from Best Evidence takes a deeper dive into answering the questions of why these banks failed, was there any warning signs, and is your bank safe.

John explains that the ‘liquidity crisis’ which had gotten worse once the Fed raised interest rates, forced many account holders to reconsider where they are keeping their money. He also shows that a number of questionable checking accounts containing billions of dollars were being maintained for years at the risk of loss or losing money since before the pandemic, making these banks extremely high risk for closure. When one bank loses depositor liabilities, like in transfers of funds to another bank, that first bank must replace those deposits with assets or be forced to take out loans. If not then it risks being shutdown or collapsing as was the case with Silicon Valley Bank, Signature Bank, and First Republic Bank. John goes into this more in his video [10:30].

There are two ways deposits get expanded on the balance sheet. The first way is through loans where the banks makes a new loan, and the loan base gets expanded. The customer who receives the loan gets it credited to his account as a deposit.

The second way deposits get expanded is when the Fed purchases non-banking assets through a commercial bank. The Fed creates these deposits out of thin air and uses them to buy non-banking Assets. The Fed cannot do this without a commercial bank being in the chain of transactions.

How this works is the bank customer transfers a U.S. Treasury or mortgage backed security to the Fed, and now the Fed needs to pay the bank customer. First, the bank credits the depositor in their account. Second, the Reserves will expand in the bank’s Assets. More details on this are in the video “Fed Admits the Crony Truth About Pandemic QE”

There is a big difference in these two methods of increasing deposits in a bank. The first one, the bank decides to offer the loan to increase their deposits. The second method, however, is decided totally by the Fed itself. The bank is forced to go along with the Fed and has no say in the transaction. Deposits large enough to take down a bank when they leave could only have come from one place, the Pandemic Quantitative Easing (QE). These $10, $20, and $100 million bank deposits were created out of thin air when these astronomical amounts were bought from bank customers by the Fed. “Whales” like these, as John describes, were never seen at this magnitude before the pandemic.

On March 28, 2023 Senator Mark Warner [17:15] speaks with FDIC Chairman Martin Gruenberg at “Senate Banking Committee hearing on the collapse of SVB and Signature Bank” notes something very interesting:

“My understanding 10 depositors alone had about $13 Billion dollars of deposits.”

Since FDIC insurance only covers $250,000, this is a huge red flag that something shady is going on here. So these 10 account holders decided to let billions of dollars sit in bank accounts for 2 to 3 years earning a fraction of what they could have earned with better interest rates like U.S. Treasuries? Yes. For starters this is highly suspicious.

Senator Mark Warner also continues “I also think the speed … [of] the largest bank failure we’ve seen was WAMU back in the crisis $16 billion dollars left that bank over a 10-day period. In this case $42 billion dollars, the equivalent of $0.25 on every deposit went out in 6-hours. I’m not sure at that point what regulatory structure could have prevented that at least from reports it seems to me that … some of the very VCs (venture capitalists) who banked for a long time at SVB may have started this run and demanded all of their ancillary companies all go out at once.”

The bank presidents of these collapsed banks would not have crashed their banks willingly. It would have taken serious threats for these massive withdrawals to go through. The bigger question is where did these billions of dollars come from and why were these billions left in these banks, with practically 0% interest earning and at risk of total loss?

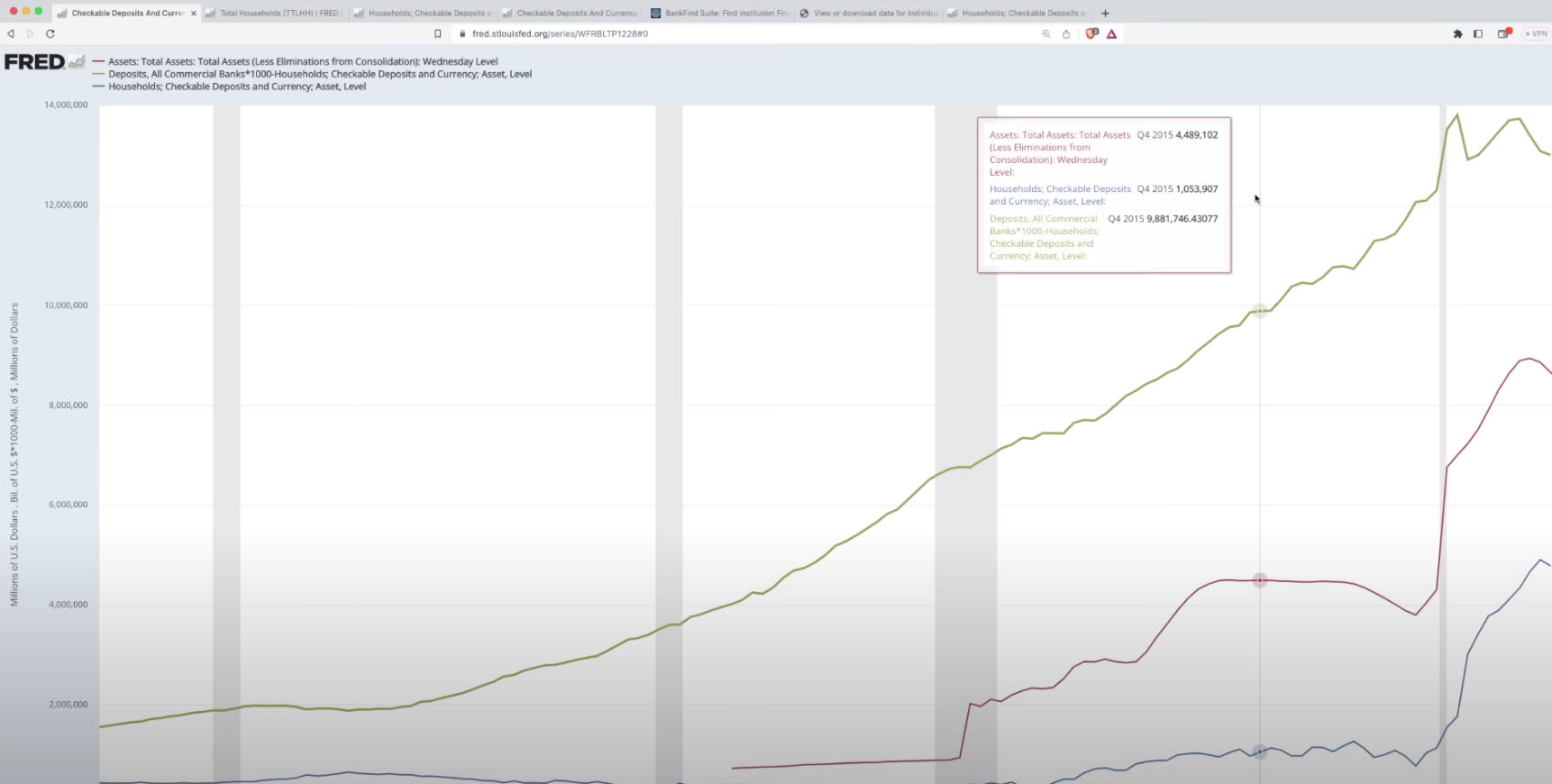

John does an excellent job of describing [23:05] how the Fed created these large accounts with the help of the publicly accessible website FRED, the St.Louis Federal Reserve database. First off, he shows that the checking accounts for the top 0.1% of households skyrockets through and after the pandemic from about $500,000+ to over $4.5 million dollars. The Fed purchasing assets increase is tied in pattern directly to the increase in the household checking accounts of the top 0.1% increase.

He continues with the FRED website to show that non-household accounts, like charities and legal entities were used as a pass through to move the Fed’s increased deposits into the bank accounts of the top 0.1% of household accounts. There was a delay during Pandemic QE before the Fed’s purchases arrived in those household accounts, and that delay was the use of the bank accounts of legal entities. This created a $3.2 trillion dollar jump in these top 0.1% household account.

These “whale”/household bank accounts were maintained for years at risk of total loss and at actual loss of interest that could have easily been earned elsewhere. Why? These bank accounts seemingly existed for the sheer ability to remove massive amounts of funds from a bank very quickly, as was the case in the 3 banks that have already failed. The Fed purchased the assets through these banks, then the Fed increased interest rates providing the reason or “excuse” for these whale accounts to bail on these banks and in turn collapsing them. Their mere existence couldn’t be explained any other way, at least not without an investigation which will likely never happen.

John does cite two examples explaining why someone would maintain billion dollar checking accounts, one was a criminal stashing money to hide from investors (Bernie Madoff). The other reason was for someone to position themself to take over controlling interest of a bank with the threat of a sudden removal of their massive deposit. Both reasons are shady and deserve investigation.

Were there warning signs that these banks were about to fail?

John says YES! He states that there are two “Red Flag Tests” that you can conduct on your own bank to see check its solvency & liquidity [46:13].

He first brings you to the FDIC’s website to review the Bank Find Suite showing the Financial & Regulatory Data. Sorting by Total Assets displays some of the banks with the largest amount of assets, and toward the top are the 3 banks that recently failed. Out of over 4,700 banks these 3 banks that failed are in the Top 32 which shows that these were not just random banks that collapsed or a regional banking crisis as is the excuse being floated. There is definitely something more going on here, and it appears to be the top banks absorbing the smaller banks, next lowest in the rung.

Warning Signs Links:

Banks.Data.FDIC.gov/bankfind-suite/financialreporting

CDR.FFIEC.gov/public/ManageFacsimiles.aspx

Data Point #1: For examining your own bank, the first piece of data to collect is the CERTIFICATE NUMBER OF YOUR BANK along with the ASSET AMOUNT. John explains that you should collect this data into a spreadsheet in order to gather and calculate how at-risk your bank may be. Panic Borrowing is another red flag you want to check about your bank. In the report labeled Assets, Liability, & Capital record the asset size of your bank. Then check Total Liabilities & Capital, Deposit Size, Other Borrowed Funds > Maturity & Repricing of Other Borrowed Funds > FHLB Advances (One Year or Less & One Year to Three Years). Compare that amount to your bank’s Total Equity. In John’s example, Silicon Valley Bank owed $15 billion dollars which was due in less than one year. This bank was in deep, deep trouble before it actually collapsed. Any borrowing from the FHLB is a big sign of trouble. John adds that the same conditions were true with Signature Bank and First Republic Bank where more than 75% of the banks’ equity was due by short term FHLB loans.

Data Point #2: John now lays out the Top 34 U.S. banks with more than $100 billion dollars in a spreadsheet, to see how these banks compare with the 3 banks that failed. The two reasons you want to refer to a spreadsheet like this is (1) so as to determine FHLB loans in percentage of equity, and the ability to add other data not necessarily from the FDIC’s website. He then sorts his list of banks on (% of Equity) and at the top of his spreadsheet are the 3 dead banks; Signature Bank (140%), Silicon Valley Bank (99%), and First Republic Bank (77%).

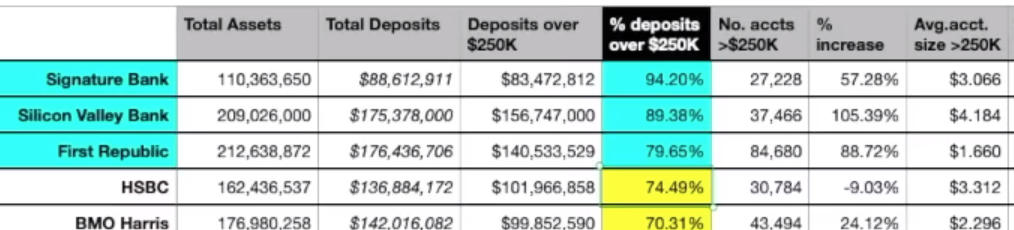

John now uses the website of the FFIEC (Federal Financial Institutions Council Central Data Repository’s Public Data Distribution) to look up the Call Report for your bank. This is why you record your Bank’s Certificate Number. First Set the Dates you want the report to produce. Under Unique Identifier and choose FDIC Certificate Number in the dropdown menu and then click Generate button. Once you bring up the report, turn to the Table of Contents and find the form Schedule RC-O. Line 1 will show Total Deposits Liabilities Before Exclusions and compare that with Total Deposit Liabilities of the Bank, Subsection b. This will show if a majority of the bank accounts in the examined bank are “whale” accounts and are uninsured. Also, John explains, if you take the amount from Subsection b. (1) and divide that by the Number of Deposit Account or More Than $250,000, Subsection b. (2), you will see the average amount of those bank accounts at the bank. In John’s example of examining Silicon Valley Bank’s report, he shows that a majority of their deposit account over $250,000 were over $4 million dollars. In this examination of (% of Deposits Over $250,000) the 3 dead banks all show at the very top; Signature Bank (94%), Silicon Valley Bank (89%), and First Republic Bank (79%).

U.S. and world history is littered with countless examples of many businesses, groups, organizations, and even political parties being consolidated into smaller and smaller numbers. The result is with smaller numbers the more easily it can be controlled. Whether it was railroads in the 1800’s, or food manufacturers now. The same is going on with banks. The more banks that collapse, the less that will need to be controlled when Central Bank Digital Currency gets implemented and required. These first few bank collapses are only the beginning of an insolvency tide that will wash over the U.S. and the rest of the world.

In my article “How the Covid-19 Pandemic is a Smokescreen For BlackRock’s Plan to Collapse the U.S. Economy With Help by the U.S. Federal Reserve and Force Worldwide Digital Currency” from almost 2 years ago John Titus previously explains how the Fed is moving to eliminate commercial banks all together. This month the new FedNow app has been launched and describes itself as an easier and more secure way to send payments instantly. Many see this advancement as the U.S. catching up with other countries in their ability to send money instantly, and some see it as a potential gateway for fraud.

We know from the words of Agustin Carstens, General Manager of the Bank of International Settlements that they desire to have control over the use of all money, right down to a $100 bill.

“We don’t know, for example, who is using a $100 bill today, we don’t know who is using a 1000 peso today. A key difference is with the CBDC is the Central Bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability and also we will have the technology to enforce that.”

Therefore what tools would have to be in place for total financial control to be accomplished?

First, you’d have to have a tool that could handle instant transfers of money. The Fed clearly does not have a monopoly on this ability, but with the new Fed Now app they now have a seat at the table. Also, by offering it cheaper and faster than the competition, they could develop that monopoly at some point in the near future. The pandemic has shown how quickly everyone was willing to trade convenience for privacy. There is a saying in the tech world, “If the product is FREE on the internet, then YOU are the product,” meaning that your data is the product for sale, you just don’t know it.

Secondly, you would need a system that identifies every person on the planet. Enter the goals of WorldCoin. World Coin is the project of Alex Blania and OpenAI’s Sam Altman who are behind the AI-powered chatbot ChapGPT. Their goal is to create a massive database of the scans of all the eyeballs of 8 billion people for the purpose of giving them a universal basic income. That income would be delivered by a decentralized cryptocurrency. Regardless of what you think of universal basic incomes, that is alot of data to house in one location. How long before the government decides they need access to this massive database for any host of reasons; pandemic, martial law, terrorism, national security, etc.? We have seen how quickly properties can be seized for any number of reasons, whether legit or not.

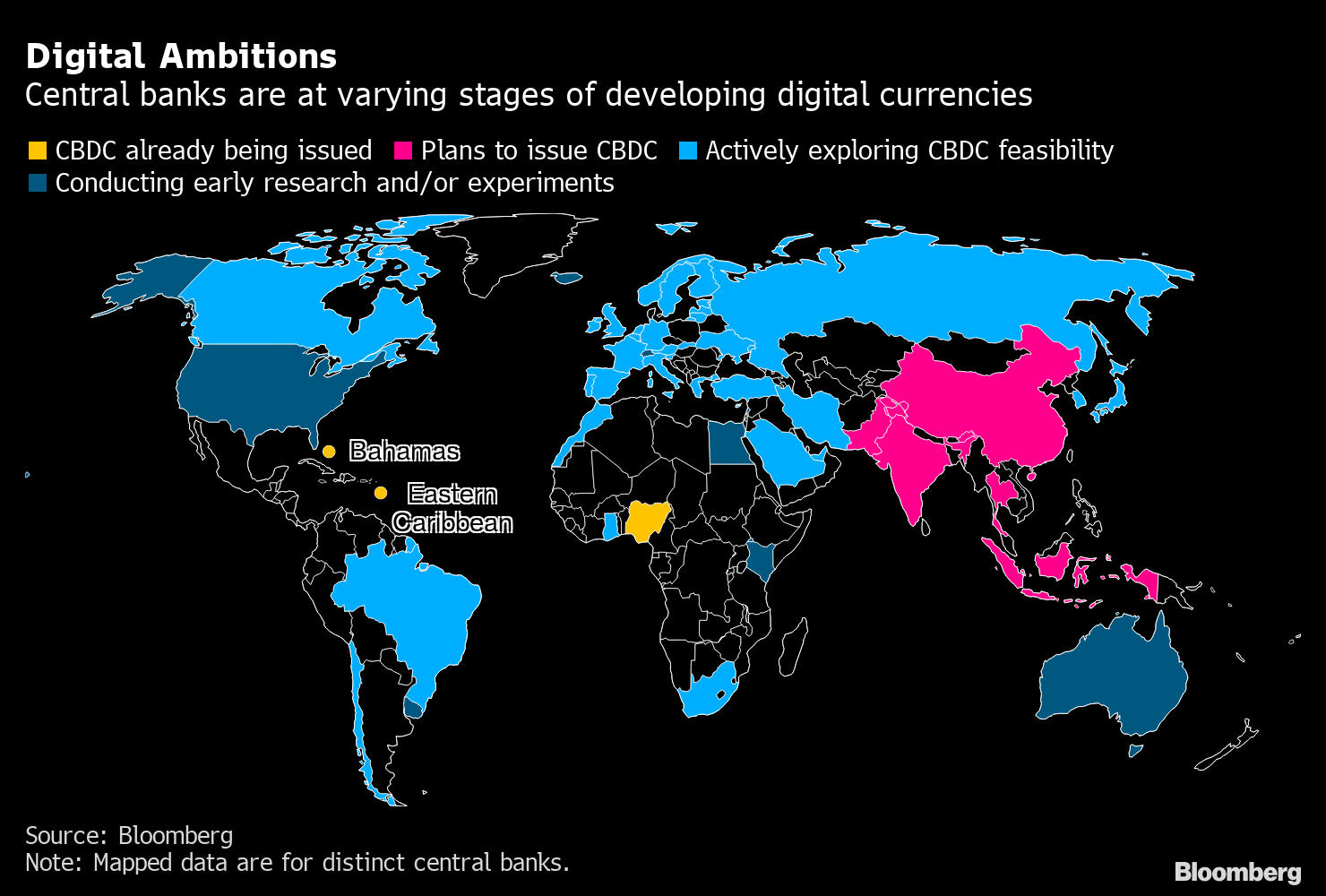

The third piece of the puzzle you’d need in the central bank digital currency itself. Many countries either have released or are working on releasing their own central bank digital currencies. The International Monetary Fund is also working on their own global central bank digital currency.

Paul Farella, Managing Director of Registered Investment Advisor Willow stated “the Fed may opt to create a digital dollar that is not a pure CBDC but rather a public-private hybrid currency,” according to Forbes.

The truth is any one of these countries could do the same thing, easily tying together all central bank digital currencies into one platform. These three fronts would give you a 3-ponged control of the financial sector and completely control all ability to buy or sell on a massive scale, especially as cash is being aggressively phased out.

We have heard for years the media and governments calling Agenda 21 or Agenda 30 or the Great Reset and the elites’ goals of garnering more control a conspiracy theory. The lockdowns of the Covid-19 “pandemic” has shown us all their plans to converge population control in the areas of finance, privacy, and our access to resources in order to sustain our lives. Never in the modern world has there been such an orchestrated mission to control every aspect of our lives as we are seeing today. The nudging away from private property ownership toward “owning nothing” and huddling the population into 15-minute cities is happening in parts of the world RIGHT NOW.

Presently, we are still ahead of the tide but that tsunami is coming and time is running out when we might be able to alter this course toward serfdom. As long as we get our cappuccinos and our Netflix shows, we are content to bury our heads in our personal lives and our normalcy bias stays intact. We must prepare for a more independent life and stop our reliance on big corps and government solutions for our lives, whether it is in health care, food, or finance. We must take lessons from those who survived huge lifestyle challenges like the Great Depression. We must also connect with other like-minded people in our local communities. The village model must resurface for us to deter as much of this aggressive control being implemented. Are you an asset or a liability in your family, in your community? Answering these questions may make all the difference, in the lives of our families and our community.

Leave a Reply